Unknown Facts About Copy Of Chapter 7 Discharge Papers

7 Simple Techniques For Bankruptcy Discharge Paperwork

Table of ContentsOur How To Obtain Bankruptcy Discharge Letter StatementsLittle Known Facts About How To Get Copy Of Bankruptcy Discharge Papers.Indicators on How Do I Get A Copy Of Bankruptcy Discharge Papers You Should KnowRumored Buzz on Copy Of Bankruptcy DischargeThe smart Trick of How To Obtain Bankruptcy Discharge Letter That Nobody is Discussing

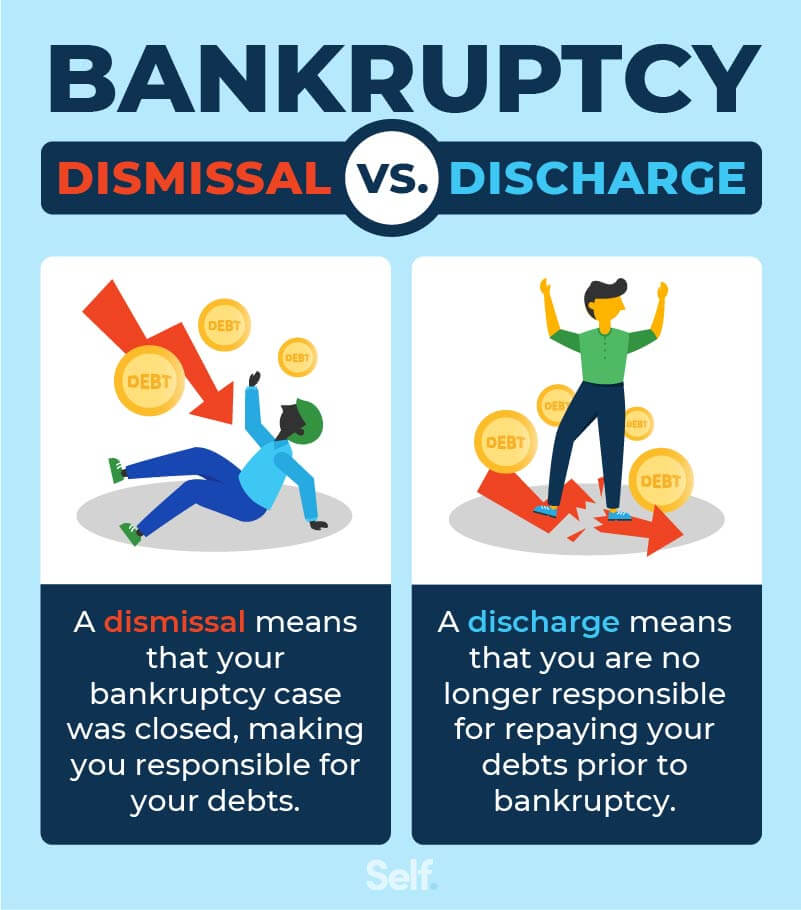

An individual debtor under Phase 7 insolvency is usually approved a discharge; however, the right to a discharge is not ensured. The notice is just a copy of the last order of discharge as well as is not details to the financial obligations the court identifies need to not be covered by the discharge. The notification notifies financial institutions that the debts owed to them have been released and also they need to not try any kind of further collection.Additionally, legitimate liens on specific property to secure settlement of debts that have actually not been discharged will certainly continue to be in effect after the discharge, and also a secured financial institution has the right to implement the liens to recoup such home. As stated over, lenders detailed on the discharge are not allowed to call the borrower or pursue collection task, and also a debtor may submit a record with the court if a creditor violates the discharge order.

Rumored Buzz on Obtaining Copy Of Bankruptcy Discharge Papers

Lots of consumers may find it testing when they make an application for debt after obtaining a discharge. Despite the fact that they may be discharged from their monetary commitments, insolvencies remain on their record for a period of seven to one decade, relying on the type of insolvency submitted. Consumers may attempt to rebuild their credit history files with secured credit report cards and financings.

Employers can not fire an existing worker who is going or has gone through the procedure of personal bankruptcy. A court can deny a discharge in Phase 7 for a number of reasons, including, amongst others, the borrower's failing to give tax obligation documents that have actually been asked for, devastation or camouflage of publications or documents, violation of a court order, or an earlier discharge in an earlier situation that started within eight years prior to the day the 2nd request was submitted, as well as failure to complete a course on individual economic monitoring.

trustee might submit an objection to the debtor's discharge. A discharge might likewise be refuted in Phase 13 if the debtor doesn't complete a course on individual financial monitoring or if they've gotten a prior discharge in one more Phase 13 instance within two years prior to the declaring of the second instance, with a couple of exemptions - https://slashdot.org/~b4nkruptcydc.

Not known Facts About Bankruptcy Discharge Paperwork

Bankruptcy Trustee, and the trustee's lawyer. The trustee directly manages your insolvency situation. This order consists of notification that lenders ought to take no additional actions to gather on the debts, or they'll deal with punishment for contempt. Maintain a copy of your order of discharge along with all your various other insolvency paperwork.

You can submit a motion with the bankruptcy court to have your instance reopened if any type of creditor tries to gather a released debt from you (how to get copy of bankruptcy discharge papers). The creditor can be fined if the court establishes that it broke the discharge order. You can try merely sending out a copy of your order of discharge to quit any kind of collection activity, and afterwards speak with a personal bankruptcy attorney about taking lawsuit if that does not work.

Getting My Bankruptcy Discharge Paperwork To Work

They consist of: Domestic commitments such youngster support, spousal support, and financial debts owed under a marital relationship settlement arrangement Specific fines, charges, and also restitution arising from criminal activities Certain taxes, including fraudulent revenue tax obligations, real estate tax that came due within the previous year, and also service taxes Court costs Financial debts connected with a drunk driving violation Condominium or other property owners' association fees that were enforced after you submitted for insolvency Retirement lendings Financial debts that weren't discharged in a previous personal bankruptcy Financial obligations that you stopped working to list on your insolvency request Some financial debts can not be released under Chapter 13 insolvency, including: Youngster assistance and spousal support, Particular fines, charges, and also restitution resulting from criminal activities, Particular taxes, including illegal earnings taxes, residential or commercial property tax obligations that ended up being due within the previous three years, as well as company tax obligations, Financial obligations you really did not checklist on your insolvency request, Financial debts incurred due to individual injury or death brought on by driving while intoxicated, Financial debts occurring from fraudulence or current deluxe acquisitions Lenders can ask that specific financial obligations not be discharged, even if discharge isn't forbidden by law.

Your personal bankruptcy defense doesn't reach joint account holders or cosigners on any of your debt obligations. Only your personal responsibility for the debt is gotten rid of when you get your personal bankruptcy discharge. Your cosigner stays responsible for the entire balance of the financial obligation. Lenders can still gather from, or even file a claim against, cosigners and joint account owners for discharged financial obligations.

The discharge takes place after all the settlements under the payment plan have actually been made in a Chapter 13 bankruptcy, typically 3 to 5 years. An insolvency discharge efficiently gets check this rid of specific debts. Financial institutions can no more try to accumulate on released financial debts, although they can still take residential or commercial property that's been vowed as security for those financial obligations.

The Single Strategy To Use For How To Get Copy Of Chapter 13 Discharge Papers

Borrowers need to realize that there are a number of options to phase 7 alleviation (how do you get a copy of your bankruptcy discharge papers). As an example, borrowers who are taken part in service, including firms, collaborations, and also single proprietorships, may choose to stay in company as well as stay clear of liquidation. Such debtors should think about submitting an application under phase 11 of the Personal bankruptcy Code.

P. 1007(b). Borrowers have to likewise give the assigned instance trustee with a copy of the tax return or transcripts for the most current tax year as well as tax obligation returns filed throughout the case (including tax returns for previous years that had actually not been filed when the situation started).